Breaking news on U.S. inflation and job market performance

Breaking news on U.S. inflation and job market performance reveals how rising inflation affects consumer spending, job availability, and necessitates adjustments for both consumers and businesses to navigate economic challenges.

Breaking news on U.S. inflation and job market performance is reshaping the economic landscape. Are you curious about how these changes impact your daily life? Let’s dive into the latest updates and insights.

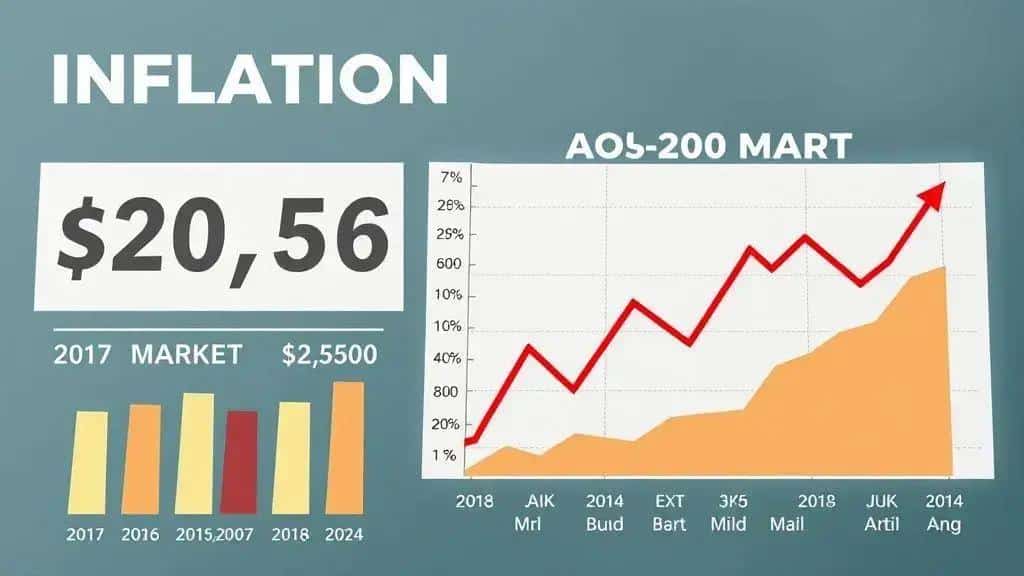

Current state of U.S. inflation rates

Understanding the current state of U.S. inflation rates is crucial for everyone. It impacts how much we pay for everyday items, and it influences economic decisions at all levels. Recent data shows a steady increase in inflation, raising concerns among consumers and businesses alike.

The inflation rate has risen significantly over the past year. This has led to an increase in prices across various sectors, including food, housing, and transportation. Notably, the Federal Reserve has been monitoring these trends closely.

Key factors driving inflation

Several elements contribute to the rising inflation rates:

- Supply chain disruptions that have caused shortages.

- Increased demand as the economy recovers post-pandemic.

- Higher energy prices affecting transportation and production costs.

Additionally, wages are also rising as employers compete for workers. This can create a situation where increased wages may contribute to further inflation, creating a cycle that can be hard to break.

While inflation can appear alarming, it’s important to consider how it might stabilize. Historical trends show that inflation can fluctuate, responding to various economic stimuli. As we move ahead, experts suggest keeping an eye on how government policies will adapt to this evolving landscape.

Impact of inflation on the job market

The impact of inflation on the job market is profound and multifaceted. As inflation rises, its effects can be seen in various aspects of employment and economic participation. Employers may face higher costs that lead to wage adjustments and hiring strategies.

When inflation increases, companies often need to raise prices to maintain their profit margins. This can lead to reduced consumer spending, ultimately affecting sales and profit. As a result, businesses might delay hiring or even make layoffs, which impacts job availability.

Effects on wages and employment opportunities

Inflation can also lead to higher wages, yet the real value of those wages may not keep pace with rising prices. This creates a challenging environment for workers:

- Workers demand higher pay to cope with increased living costs.

- Employers may freeze hiring or limit new positions due to uncertainty.

- Industries tend to prioritize skilled workers, impacting entry-level jobs.

Additionally, sectors like retail and service industries might see shifts in staffing needs. Companies often need to balance between adequate staffing and the rising costs of labor. Hence, some businesses may invest in technology or automation rather than hiring new employees.

Understanding these dynamics is crucial for job seekers and employers alike. While inflation can drive wages higher, it simultaneously can create an unstable job market. Workers may feel pressured to accept job offers that don’t meet their expectations due to a lack of options, while companies navigate their own financial pressures.

Recent job growth trends in the U.S.

Analyzing recent job growth trends in the U.S. helps us understand the current economic climate. Job growth is essential for a healthy economy, and recent statistics reveal both positive and negative aspects of the labor market.

In the past few months, the U.S. has seen a rebound in job creation. Various industries are recovering from the setbacks caused by the pandemic. For example, hospitality and leisure sectors are experiencing strong growth as consumers return to normal activities.

Key sectors driving job growth

Several key sectors have fueled this job growth:

- Healthcare: Increased demand for healthcare services has led to more openings in this field.

- Technology: The tech sector continues to expand, creating a wealth of opportunities.

- Construction: With ongoing infrastructure projects, construction jobs have surged.

- Retail: The reopening of stores has boosted hiring in retail businesses.

This diverse job growth highlights the economy’s resilience. However, challenges remain. Some workers are still hesitant to return to positions that require in-person attendance. The overall job market is competitive, with employers seeking skilled labor to meet their needs.

Despite these challenges, the trends show promise. Economic policies and ongoing investments in key sectors aim to sustain this job growth. Monitoring these trends will be vital for job seekers and businesses alike.

Expert opinions on economic forecasts

Examining expert opinions on economic forecasts is essential for understanding future trends. Economists and financial analysts closely monitor various indicators to predict how the economy will behave. Their insights help businesses and consumers plan ahead.

Recent analyses suggest a mixed outlook for the economy. While some experts see signs of recovery, others express caution due to persistent inflation and potential supply chain issues. These varying views highlight the complexity of economic forecasting.

Key factors influencing forecasts

Several factors shape these expert opinions:

- Inflation rates: Many economists believe inflation will stabilize but caution against underestimating its impact.

- Labor market conditions: The strength of job growth and wage increases can drive economic recovery.

- Global economic trends: International markets and trade policies play a significant role in U.S. economic health.

Additionally, the effects of government policies, such as interest rates and fiscal stimulus, also come into play. Experts argue that careful monitoring of these policies is crucial in making accurate predictions.

Overall, expert opinions provide valuable guidance. By analyzing the current economic landscape, businesses can make informed decisions. Consumers can also better understand how these forecasts may affect their finances in the future.

Future implications for consumers and businesses

Understanding the future implications for consumers and businesses is crucial as the economy evolves. Economic changes affect how companies operate and how consumers make purchasing decisions. Awareness of these trends can lead to better planning and improved financial health.

As the inflation rate stabilizes, consumers might see a return of normalcy in pricing. However, persistent inflation can lead to higher prices on essential goods. This situation could force consumers to adjust their spending habits, prioritizing necessities over luxuries.

Potential impacts on consumers

Some key future implications for consumers include:

- Budget adjustments: Households may need to revisit their budgets and cut back on discretionary spending.

- Increased savings: People might prioritize saving more in uncertain economic times.

- Shift in consumer preferences: As prices rise, consumers may opt for generic brands over name brands.

On the business side, companies must navigate these changes carefully. Understanding consumer behavior becomes essential for maintaining a loyal customer base. Businesses should consider innovative pricing strategies and focus on providing value to attract buyers.

Additionally, the evolving landscape may push businesses to invest in technology and automation. These investments can help streamline operations and reduce costs in the long run. Companies that effectively adapt to these economic changes can position themselves for success.

FAQ – Frequently Asked Questions About U.S. Inflation and Job Market Performance

What impact does inflation have on consumer spending?

Inflation can lead to higher prices for goods and services, causing consumers to adjust their budgets and prioritize essential items over luxuries.

How is the job market affected by rising inflation?

Rising inflation can lead to layoffs or hiring freezes as businesses face higher costs. However, some industries may also grow as demand shifts.

What should businesses do to adapt to inflationary pressures?

Businesses should consider adjusting their pricing strategies, investing in technology, and optimizing operations to manage costs.

How can consumers prepare for economic changes?

Consumers can prepare by reviewing their budgets, increasing savings, and being mindful of their spending habits during uncertain economic times.